If you want to check PAN card with Aadhar card then how to check it, its complete process is given below, you can check it.

Aadhar Card Number Se Pan Card Number Kaise Pata Kare

To check PAN card with Aadhar card number, follow the steps given below –

- To check PAN card from Aadhaar number, click on Click Here button.

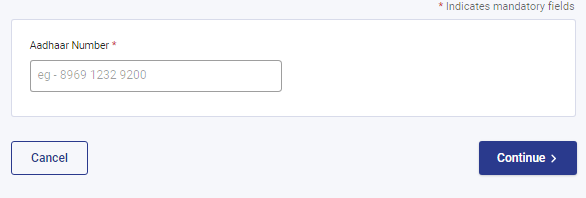

- After visiting the link, click “Check Status/ Download PAN” Check Status/ Download PAN – Check status of pending e-PAN request / Download e-PAN. In that option you will see “Continue” button.

- You will get the option to enter “Aadhaar Number” and then enter your 12 digit Aadhaar Card Number.

Fill the Aadhar Card Number and click on Continue Button. - As soon as you fill the Aadhaar number and click on the continue button, you will be able to see the details of the PAN card linked to the Aadhaar card.

1800 180 1961 call this toll free number for know full pan number.

PAN Card Check By Aadhar Card Number 2024 ?

The Permanent Account Number (PAN) and Aadhaar Card are two crucial identification documents in India, often required for various financial and governmental transactions. While they serve different purposes, there are instances where you might need to link or cross-reference them. However, directly finding a PAN Card Number using an Aadhaar Card Number isn’t officially supported by government portals or systems. Nonetheless, there are alternative methods to achieve this, as discussed below.

-

Linking PAN Card with Aadhaar Card:

- Before attempting to find your PAN Card Number using your Aadhaar Card Number, ensure that your PAN card is linked with your Aadhaar card. This linkage can be done through the Income Tax India website or offline by submitting the required documents.

- Once linked, your PAN card details become accessible through Aadhaar-based e-KYC services offered by certain financial institutions and government-approved platforms.

- Using Aadhaar-based e-KYC Services:

- Several financial institutions and government-approved platforms provide Aadhaar-based e-KYC services, allowing individuals to authenticate themselves using their Aadhaar details.

- Through these services, users can provide their Aadhaar Card Number for verification, and if the Aadhaar is linked with PAN, the associated PAN Card Number may be displayed as part of the verification process.

-

Contacting Income Tax Department:

- If you urgently need your PAN Card Number and have your Aadhaar Card Number available, you can consider contacting the Income Tax Department helpline or visiting a nearby Income Tax Office.

- Provide your Aadhaar Card details and explain your situation to the officials. They may assist you in retrieving your PAN Card Number or guide you through the necessary steps.

-

Registering on Income Tax India Portal:

- Another approach is to register on the Income Tax India portal using your Aadhaar Card Number.

- After successful registration, you may be able to access your PAN Card details or request a reissue of your PAN Card if needed.

Conclusion:

While there isn’t a direct online method to find your PAN Card Number using your Aadhaar Card Number, you can still accomplish this indirectly through Aadhaar-based e-KYC services provided by certain institutions or by contacting the Income Tax Department directly.

It’s essential to ensure that your PAN card is linked with your Aadhaar card to facilitate such processes effectively.

Additionally, stay updated with the latest guidelines and procedures from official government sources regarding PAN and Aadhaar-related services.

(Note: Always exercise caution when sharing personal identification details online and ensure you use only government-approved and secure platforms for such transactions.)

Pan Card Check by Aadhar Card Number Online ?

To check PAN card with Aadhaar online, you can also use the PAN Error Solution website –

- To check PAN Card, you can visit PAN Error Solution Link.

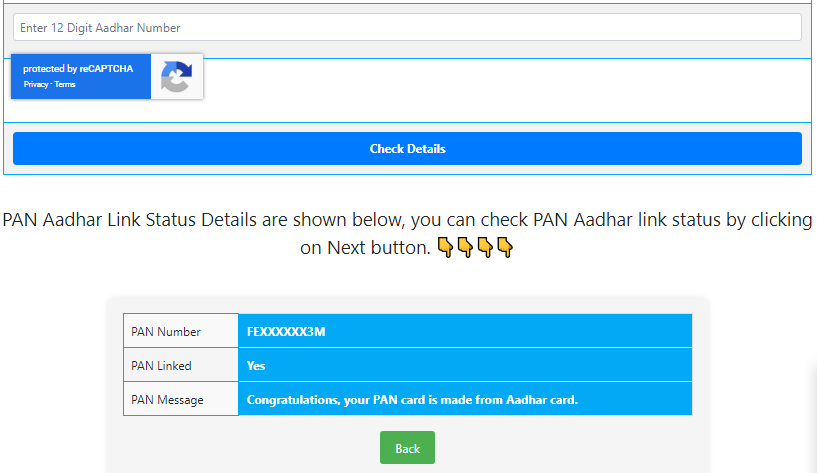

- You will get the option to enter PAN card number and Aadhaar card number simultaneously but you have to fill only Aadhaar card number and the PAN card number option should be kept blank.

- Open the pan number option and fill the aadhaar card number and then click on the check button.

- After filling the 12 Digit Aadhar Number, you will click on the “Check Details” button and then using the link you will be able to see some information about the PAN card.

- To check your PAN card data, you will find Next button below, click on it.

- You will be able to find out whether a PAN card has been made from your Aadhar card or not, if a PAN card has been made, it will be too short/hidden PAN will not be visible.

- You will get the solution of all your errors on pan error solution website, this website is apibase. You have to login with Gmail by clicking on the link, then open the link.Note: If this link in the feature does not close/does not work then wait for the new update, you will be informed about the new article.