Aaj ham AEPS Service ke bare me janane vale hai yah AEPS kya hota hai, Yah kaise liya jaata hai Isase kya kya kaam kiya jata hai, Sab kuchh is mein aapako janane ko mil jayega.

What is aeps service in hindi

AEPS Ka Full Form Aadhaar Enabled Payment System Hota hai, Yah AEPS Service NPCI Ke dwara chalu kiya gaya hai, isaka main purpose hai customer ki banking service ko safe and easy banana hai, aap aeps service ke istemal karate huaa aap aadhar number se apane kisi bhi bank account ka balance check kar sakate ho aur sath hi 10,000 rupees tak aap paise nikal sakate ho fingerprint verify karke

AEPS seva ka istemaal karane se logo ko apana bank account ka information kisi ke sath share nahin karana hota hai, Only Aadhaar number aur bank ka name istemaal kiya jata hai Fir Aap Bank Balance Check kar sakate ho Sath hi Rupee bhi Nikal sakate ho, dono seva ka benefit lene ke lie biometric karavaana hota hai, yah seva bahut hi secure hota hai govt. through approval seva hai.

Aadhar card se paise nikalne ke liye kya karna chahiye

Agar aap bhi Aadhaar se paise check aur nikalane ki seva start karana chahate hai to niche die step ko follow kare

Aadhaar card se paise check aur nikalane ke lie apake paas ek aeps id hona chahie

AEPS ID lene ke lie Aadhar Card, PAn Card, Mobile Number, eMail id ki jarurat hoti hai

AEPS ID Lene Ke liye All Document ke sath 9672 56 4095 par whatsapp par chart karna hai

Fir kuchh ghante mein aapaka aeps id ready ho ke aapako sms/message ke dvara mobile par User & password Website Apps link bhej diya jayega fir aap kam start kar sakate ho

Aap only unhi ka Aadhar se balance check aur rupee nikalane ka kaam kar sakate ho jinaka Aadhaar number bank account se link ho

How to check Bank Balance Online

Is seva se aapako yah pata chal jaayega kee aapake khata mein paisa kab aur kaisa aaya hai aur total kitana balance hai, jaise ham bank mein paas book ki entry karate hai vaise hi entry aapako online dekhane ko mil jaata hai.

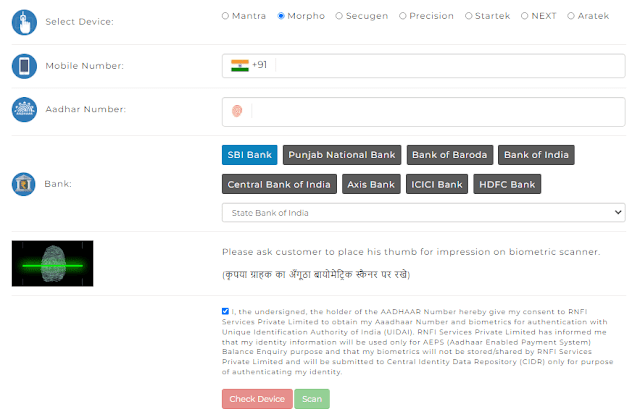

- To take advantage of this service, you must have a finger print machine, which company’s finger print device it supports, their name can be seen in the image,

- You have to enter any mobile number, it is not necessary that that number should be linked to your bank account,

- Enter the Aadhar card number of your 12 number, remember this number must be linked to your bank account, then you can take advantage of this service,

- In which bank your account is open, select the name of that bank, some important banks will be visible outside you, which are other banks, their name will have to be searched and selected by clicking on the select bank name below.

- Click on Check Device, on clicking this, it will check whether your fingerprint device is connected to your system or not, if everything goes well then you will get to see the message successfully

- Then by clicking on the Scan button, the light will be lit in the device, put a finger print of the bank account holder on it, after that you will show you the total balance in his bank account.

Aadhar Card Se Paise Kaise Nikale

There is not much difference between these two, with both the options you can withdraw money from Aadhar card, but Aadhar Pay is a little better option than wish Vidraval, if you withdraw money from someone’s account and he does not withdraw the payment and he LIMIT tells you, this limit tells you when you try to withdraw more than ten thousand money, if you withdraw money from Aadhar Pay then no one will tell you the limit, from here you can withdraw money up to 50,000 fifty thousand Ho. So this is the only difference, the process of withdrawing money in both is equal in both of them.

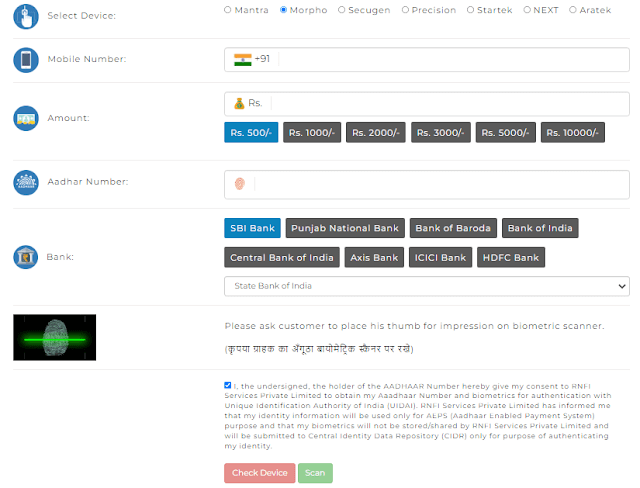

Select your finger print device and enter mobile number

Select or enter the amount you want to withdraw

Enter Aadhar card number which is linked with the bank

Then select your bank name, then click on Check Device Button, then click on Scan Button, put the finger of the customer, after that you will get to see the message of the payment will be successfully removed.

All bank aeps withdrawal limit pdf

RBI ne aeps ke through kiye gaye transaction ki koi limit tay nahi ki hai,

Halanki, some Banks ne payment system ke side effects ko kam karane ke lie

aeps ke maadhyam se kie gaye transaction ko rok diya hai, kuchh banko ne aeps

service par limit laga diya hai, agar kisi ko mota amount nikalna ho to bank me

visit karna hoga

India me jitane bhi bank hai sab ne aeps limit ki list jari ki hai kis bank ne

daily aur monthly withdrawal kar sakate hai. niche list me check kar sakate ho.

| Name of Bank | Type | Per Day Limit | Per Month Limit | ||

| No. of transactions | Amount of Transaction | No. of Transactions | Amount of Transactions | ||

| State Bank of India | PSB | 1 | 10000 | 4 | 40000 |

| Pragathi Krishna Grameena Bank | RRB | 5 | 10000 | 15 | 100000 |

| Kerala Gramin Bank | RRB | 5 | 5000 | NA | NA |

| City Union Bank | PVT | 5 | 2500 | 100 | 50000 |

| United Bank of India | PSB | 1 | 10000 | No Limit | No Limit |

| Uttarbanga Kshetriya Gramin Bank | RRB | 2 | 20000 | 5 | 50000 |

| Corporation Bank | PSB | 5 | No Limit | No Limit | No Limit |

| Uttarakhand Gramin Bank | RRB | 3 | 10000 | 90 | 3000000 |

| Central Bank of India | PSB | 2 | 10000 | 10 | 100000 |

| Baroda Gujrat Gramin Bank | RRB | 5 | 10000 | 5 | 50000 |

| Bank of Baroda | PSB | 4 | 10000 | 4 | 40000 |

| Baroda UP Gramin Bank | RRB | 5 | 10000 | 5 | 50000 |

| Baroda Rajasthan KGB | RRB | 5 | 50000 | 5 | 50000 |

| Andhra Pradesh Grameena Vikas Bank | RRB | 2 | 20000 | 60 | 600000 |

| South Indian Bank | PSB | 3 | 30000 | 90 | 1500000 |

| Axis Bank | PVT | 4 | 40000 | No Limit | No Limit |

| Andhra Pragathi Gramin Bank | RRB | 5 | 10000 | 10 | 10000 |

| Yes Bank | PVT | 5 | 40000 | No Limit | No Limit |

| Fino Payment Bank | PVT | 1 | 10000 | 15 | 50000 |

| ICICI Bank | PVT | 5 | 25000 | 15 | 25000 |

| Karnataka Bank Limited | PVT | 5 | 10000 | 150 | 300000 |

| Andhra Bank | PSB | – | 10000 | 5 | 30000 |

| AU Small Finance Bank | PVT | 2 | 10000 | 10 | 50000 |

| Federal Bank | PVT | 1 | 10000 | 4 | 40000 |

| IDBI Bank | PVT | 2 | 10000 | 10 | 50000 |

| IDFC Bank | PVT | 2 | 10000 | 10 | 50000 |

| IndusInd Bank | PVT | 2 | 10000 | 10 | 50000 |

| Kotak Mahindra Bank | PVT | 2 | 10000 | 10 | 50000 |

| HDFC Bank | PVT | 2 | 10000 | 10 | 50000 |

| Oriental Bank of Commerce | PVT | 2 | 10000 | 5 | 25000 |

| Airtel Payment Bank | PVT | 2 | 10000 | 10 | 50000 |

| Odisha Gramya Bank | RRB | 1 | 10000 | NA | NA |

| Odisha Gramya Bank | RRB | 1 | 10000 | NA | NA |

| Punjab National Bank | PSB | 2 | 10000 | 10 | 50000 |

| Punjab & Sindh Bank | PSB | 2 | 10000 | 10 | 50000 |

| Indian Bank | PSB | 2 | 10000 | 10 | 50000 |

| Allahabad Bank | PSB | 2 | 10000 | No Limit | No Limit |

| Andhra Bank | PSB | 4 | 25000 | No Limit | No Limit |

| Union Bank | PSB | 2 | 10000 | No Limit | No Limit |