Area Code AO Type Range Code AO Number Search, AO Number Search || Find PAN AO Code

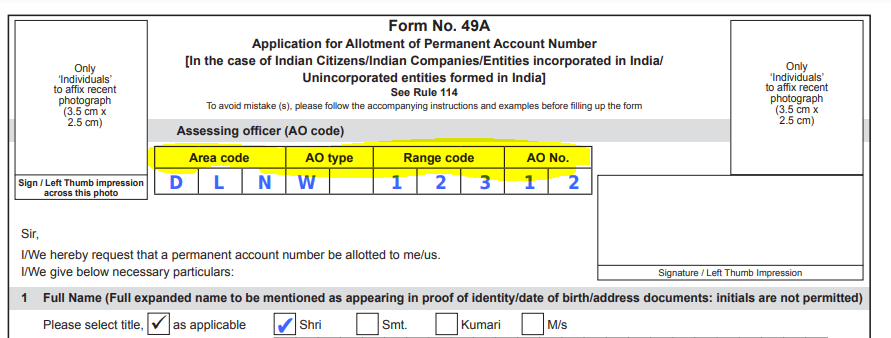

If you are applying for a new PAN card, you are required to enter the AO code while filling the PAN card form.

If you do not know where to get AO code, how to search for AO code, what is AO code, what will happen if wrong AO code is filled. Everything is going to be covered in this article.

The AO (Assessing Officer) code for a PAN (Permanent Account Number) card is a unique code assigned by the Income Tax Department to identify the jurisdictional Assessing Officer responsible for assessing the taxpayer’s income and ensuring compliance with tax laws. The AO code typically consists of a combination of alphabets and numbers and varies based on the jurisdictional area.

Here’s how the AO code is structured:

1. First Part : The first part of the AO code generally consists of the jurisdictional range code. It indicates the region or area under the jurisdiction of the Assessing Officer.

2. Second Part: The second part of the AO code includes additional codes or numbers that further specify the jurisdiction or category of taxpayers.

3. Third Part: In some cases, there might be a third part to the AO code, which could indicate specific details or divisions within the jurisdiction.

It’s important to note that the AO code is crucial for various tax-related purposes, including tax filing, communication with the Income Tax Department, and resolving tax issues. Taxpayers should ensure they have accurate information regarding their AO code to facilitate smooth processing of their tax-related matters.

To obtain the AO code for a PAN card, taxpayers can refer to their PAN card itself, where the AO code is usually mentioned. Additionally, the Income Tax Department’s official website provides resources and tools for taxpayers to search for their AO code using their PAN number. These online platforms enable taxpayers to retrieve their AO code conveniently and efficiently. If further assistance is required, taxpayers can reach out to the Income Tax Department directly through their helpline or visit their local Income Tax Office for support.

What is the full form of AO?

The full form of AO is Assessing Officer. He is a city level officer, he is a city level officer, he is in the income tax office of the city.

Why is AO code taken?

If you have filled the AO code then it will benefit you, if you have filled the AO code wrong then it is your loss, if you have entered the correct AO number then you will not face any problem related to PAN card in the feature. Wow, how? Wow, if your PAN card gets blocked, PAN card is lost, PAN card is misused, PAN card has to be surrendered, PAN card has to be delinked from Aadhaar card, then it is very important to have the correct AO code. If the AO code in your PAN card is correct, then you could get all this work done by going to the Income Tax Office of the city in which the AO code was used. If you had used the AO code of any other city, then you could get it done in your city. You could get information about your place of residence. If it is very far from the city then you will have a lot of trouble in asking there. Said your work should not be done either.

Is there a separate AO code for students?

No, AO code is allotted to the city and not to an individual, the city you belong to will have a separate AO code available which you can use to apply for PAN card form.

AO Code for PAN Individual Income?

No, AO code is not as per individual or no income. Balki is city wise. Every city has an AO code, which can be used by a person residing in our city.

Find AO Number || Search PAN AO Code

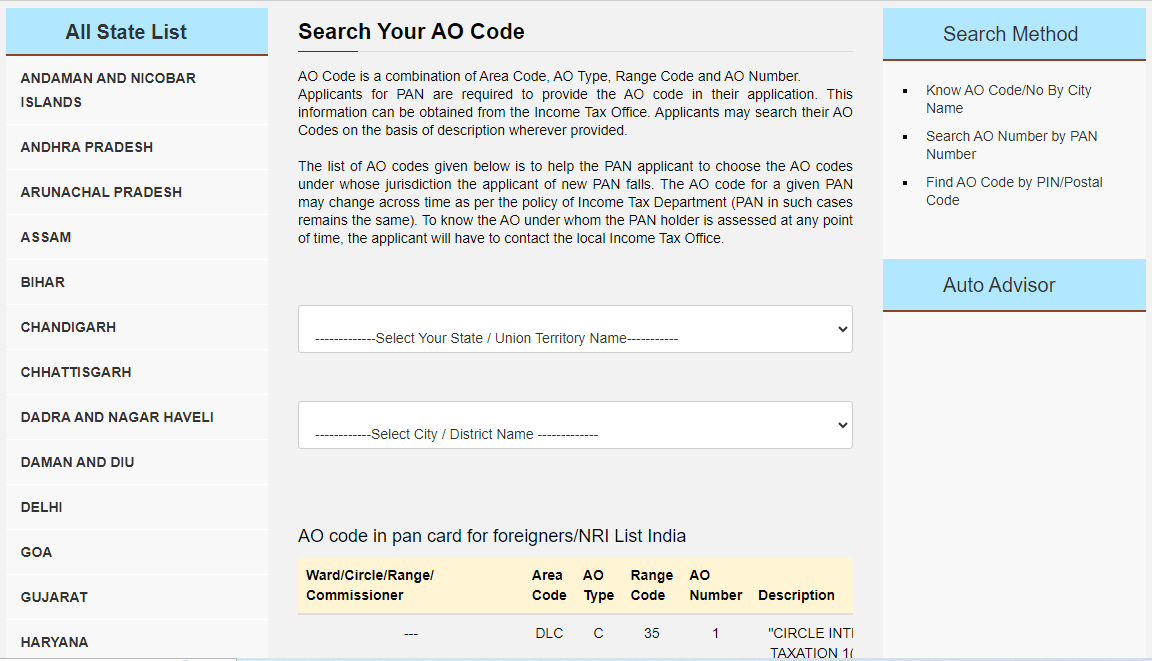

To find or find AO code or AO number online, follow the steps given below.

Step 1:- To find AO code online https://aocodefind.go24.info/ Visit this link

Step 2:- You will find an interface like this, now you have to Select the name of the state.

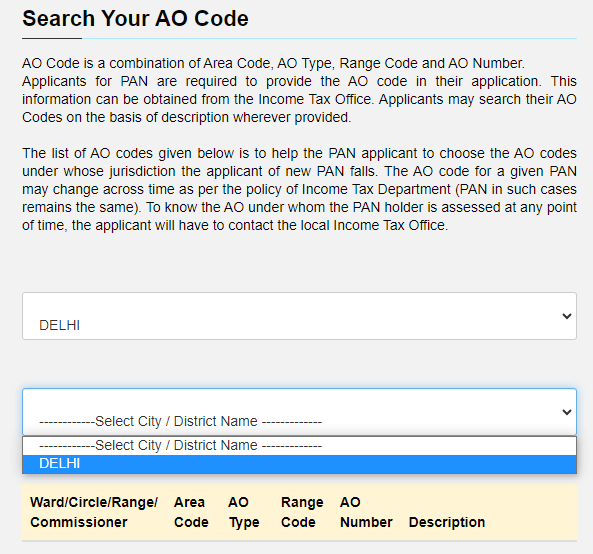

Step 3:- Then you have to display City Name, you have to select the city name.

Step 4:-The list of AO codes similar to ours is opened, we have lots of AO numbers getting displayed. Now fill in the AO Code PAN form and enter it.

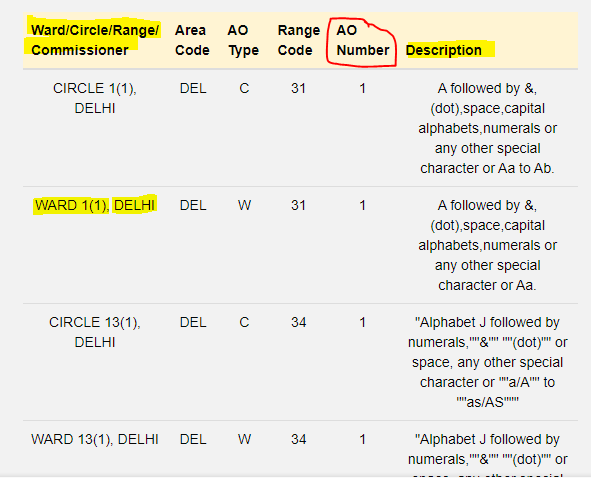

Step 5:-Choose the correct AO code, to do this some hints are given to you by which you can choose the correct AO number.

Step 6:- To find the AO code, you have to first check the list “Ward/Circle/Range/Commissioner“, in this you have to check which ward is there in it. No circle no range or name that is coming. Is he from your area? It is possible that the ward number being mentioned is the same. Is it the ward number of your area? If it is the same then you can use the AO code given below.

Step 7:- “Details” I will display some of your city name which will be Taluka name from here also it becomes easy for you select AO code me

Step 8:-This way you can check AO code details. For this only the name of the state or the name of the city is required.