PAN Card AO Number, AO Type, AO Range, AO Area Code Search By Family PAN Card Number – This information can be obtained from the Income Tax Office. Applicants may search their AO Codes on the basis of description wherever provided. Alternatively, applicants may search for their AO Code in the AO Code Search as per the guidelines below.

Permanent Account Number abbreviated as PAN is a unique 10-digit alphanumeric number issued by the Income Tax Department to Indian taxpayers. The department records all tax-related transactions and information of an individual against his unique permanent account number.

Understanding PAN Card AO Code: A Comprehensive Guide

A PAN (Permanent Account Number) card is a unique identification number assigned to individuals and entities for tax purposes in India. Each PAN card has a unique AO (Assessing Officer) code associated with it. The AO code helps in determining the jurisdiction under which an individual’s or entity’s taxes are assessed.

What is an AO Code?

The AO code is a combination of several parameters that determine the Assessing Officer’s jurisdiction for a particular PAN card holder. These parameters include:

- Area Code: It represents the geographical area of jurisdiction of the Assessing Officer.

- AO Type: It signifies the type of Assessing Officer, such as Individual, Company, Trust, etc.

- Range Code: It indicates the range within the area code where the Assessing Officer has jurisdiction.

- AO Number: It is a unique number assigned to each Assessing Officer within a specific range.

How to Find AO Code?

There are various methods to find the AO code associated with a PAN card:

- Visit the official Income Tax Department website (https://www.incometaxindia.gov.in) and use the AO code search tool.

- Contact the nearest Income Tax office and inquire about the AO code.

- Refer to the PAN card application form, where the AO code is often mentioned.

- Check the acknowledgment receipt provided after submitting the PAN card application.

Importance of AO Code

The AO code is crucial for various tax-related processes, including:

- Filing Income Tax Returns

- Applying for PAN card corrections or updates

- Communication with the Income Tax Department regarding tax matters

Conclusion

Understanding the PAN card AO code is essential for taxpayers in India. It helps in ensuring compliance with tax regulations and facilitates efficient communication with the Income Tax Department. By knowing their AO code, individuals and entities can streamline various tax-related processes and avoid unnecessary complications.

For further assistance regarding AO code or any tax-related queries, individuals can always reach out to the Income Tax Department or consult a tax professional.

PAN Card AO Number Search By PAN Number

In India, the Permanent Account Number (PAN) is a crucial identification tool for taxpayers. Issued by the Income Tax Department under the supervision of the Central Board of Direct Taxes (CBDT), the PAN card serves various purposes, including filing tax returns, conducting financial transactions, and more. Each PAN card is unique and contains essential information about the holder, such as their name, date of birth, and PAN number. However, sometimes individuals may need to retrieve additional details related to their PAN card, such as the Assessing Officer (AO) number associated with it. In this article, we’ll delve into the process of PAN card AO number search by PAN number and explore its significance.

Understanding PAN Card AO Number:

Before delving into the process of searching for the AO number using the PAN number, it’s crucial to understand what the AO number signifies. The AO number is a code assigned to each taxpayer by the Income Tax Department. It identifies the jurisdictional Assessing Officer who is responsible for assessing the taxpayer’s income and ensuring compliance with tax laws.

The AO number typically consists of a combination of alphabets and numbers and varies based on the jurisdictional area. It helps the Income Tax Department streamline its operations by assigning specific officers to handle tax assessments for different regions.

Importance of Knowing AO Number:

Knowing your AO number is essential for several reasons:

-

Communication with Income Tax Department: If you need to communicate with the Income Tax Department regarding your tax matters, providing your AO number can expedite the process and ensure that your queries are directed to the relevant authority.

-

Tax Filing and Compliance: When filing income tax returns or engaging in any tax-related activities, understanding your AO number ensures that your documents reach the appropriate assessing officer, facilitating smooth processing and compliance.

-

Resolving Tax Issues: In case of any discrepancies or issues related to your taxes, knowing your AO number can aid in resolving them efficiently by directing your concerns to the right authority.

How to Search for AO Number by PAN Number:

The process of searching for the AO number using the PAN number has been simplified by the Income Tax Department through its online portal. Here’s a step-by-step guide:

-

Visit the Official Income Tax Department Website: Access the official website of the Income Tax Department of India. Ensure that you are using a secure and trusted internet connection to protect your personal information https://www.incometax.gov.in/iec/foportal/

-

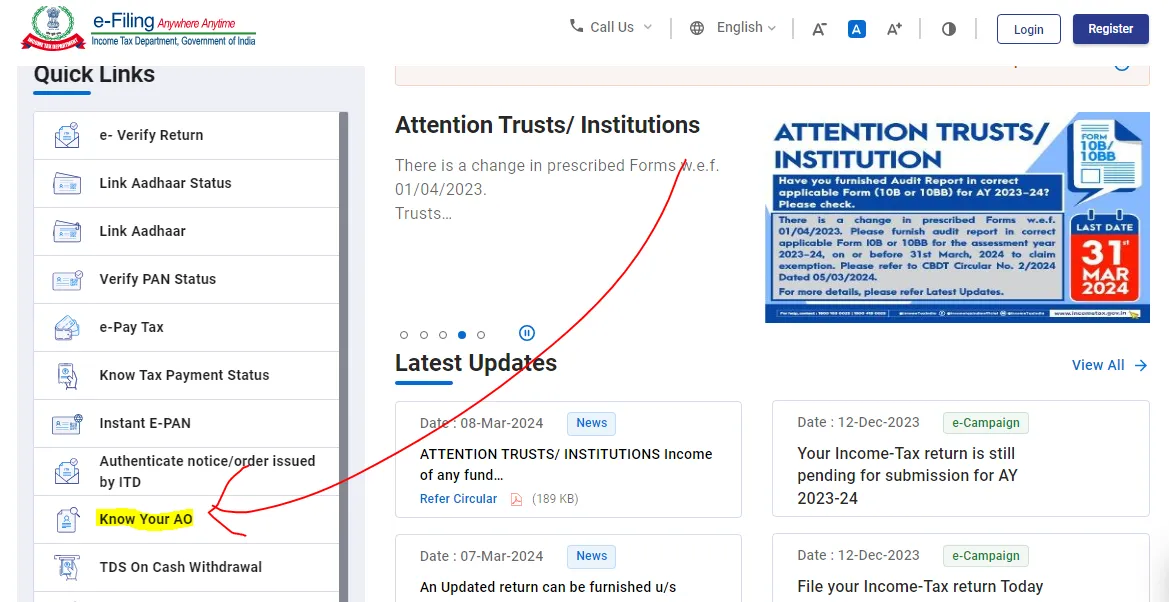

Navigate to ‘Know Your AO’ Section: Look for the ‘Know Your AO’ section on the website. This section is specifically designed to assist taxpayers in retrieving information related to their PAN cards.

-

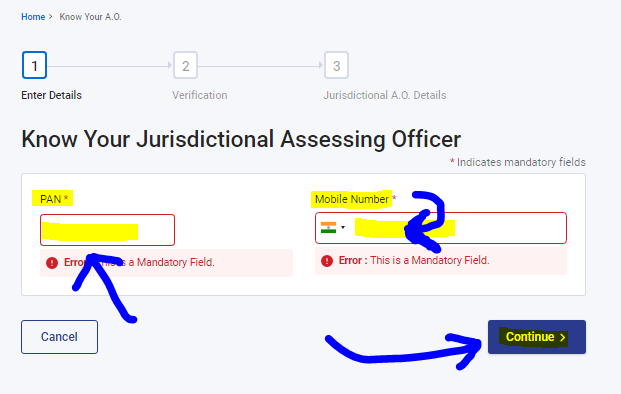

Enter PAN Number: In the provided field, enter your PAN number accurately. Double-check the PAN number to avoid any errors that might lead to incorrect search results.

-

Enter Mobile Number: In Mobile Number, you can give any mobile number you have, there is no need to link it with PAN number.

-

-

Click on Continue: Enter the PAN number of the PAN card for which you want to check AO Number details. Then enter any mobile number you have to receive OTP. Then Continue.

-

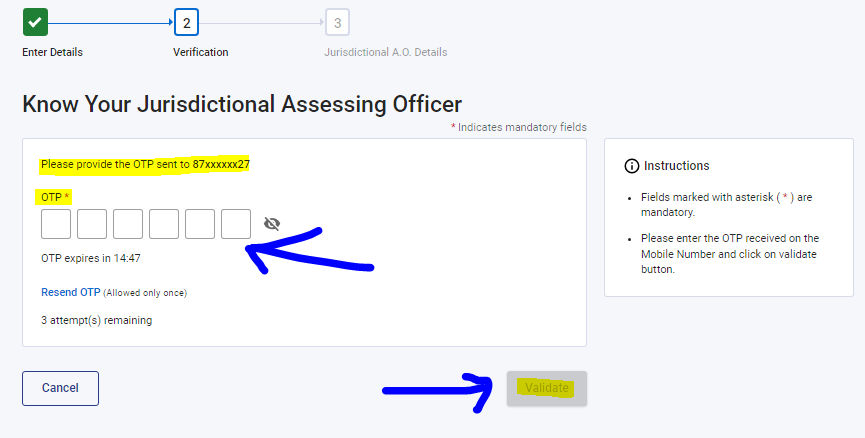

Enter 6 Digit OTP : 6 digit OTP code has been sent to the mobile number you had entered, now enter that OTP here, if OTP is not received then you can Resend OTP or change the mobile number.

-

-

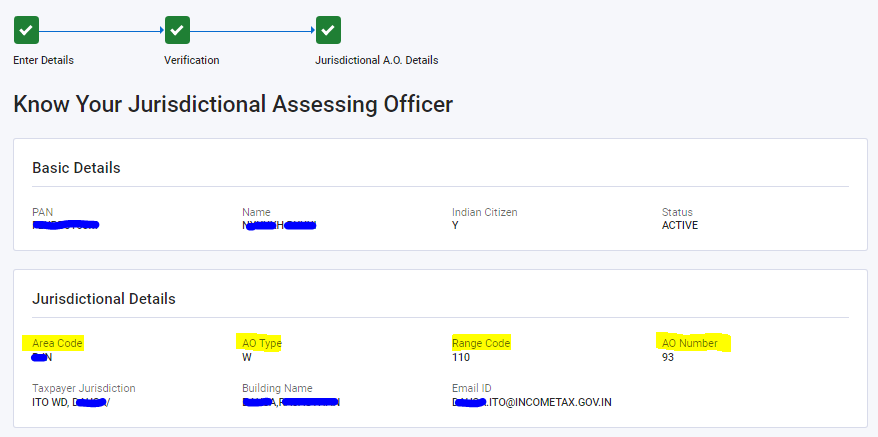

View AO Number: So you can see here that the AO Code Number details of the PAN number that you had entered has been displayed here, here you get to see AO Number, Range Code, AO Type, Area Code etc. in the PAN AO Information.

Alternative Methods:

If you encounter any difficulties using the online portal or prefer alternative methods, you can consider the following options:

-

Contacting Income Tax Department: You can reach out to the Income Tax Department directly through their helpline or email support. Provide your PAN number and request assistance in retrieving your AO number. Be prepared to verify your identity for security purposes.

-

Visiting Local Income Tax Office: If you prefer a more traditional approach, you can visit your local Income Tax Office and inquire about your AO number in person. Bring along your PAN card and any other identification documents that may be required.

Conclusion:

In conclusion, retrieving your AO number using your PAN number is a straightforward process facilitated by the Income Tax Department’s online portal. By understanding the significance of the AO number and following the steps outlined in this article, taxpayers can easily access this essential information. Knowing your AO number not only streamlines tax-related processes but also ensures compliance and facilitates effective communication with the Income Tax Department. Therefore, it is advisable for taxpayers to proactively retrieve and maintain records of their AO numbers for future reference and convenience.