Do you also want to surrender your PAN card or get you closed, or if you want to Delink Aadhar card with PAN card, then how can you do it, and at which address we have to submit the letter, how did we write the letter? Was submitted in the Income Tax Office, and at which address the letter has to be submitted, we are going to tell you all in this article.

How to Write Letter for Pan Card Surrender or Delink

Many people are thinking that how to write a letter, write in English or in your local language, what to mention in the letter and what to write, first you can write this letter in any language, if possible in English language. Write, we have to tell in the letter that we have so many PAN cards, out of which I have this PAN number ABCD1234A which I have to keep with me, the rest of the PAN card is as follows, DCBA0000D which I have to surrender, please Surrender or Delink my PAN card, you have to write something like this

To

The Income Tax Department

{Your District Income

Tax Office Address}

Sub: To surrender/Delink your PAN card

Respected Sir/Madam,

I, [write your full name] I am writing this letter to you that I lost my PAN card during travel few months back. I have applied for new pan card and my pan card is also generated but just few days back i got old pan card. So i have to surrender my one pan card which is DCBA0000D which is a pan card extra ABCD1234A i want to keep it with me please surrender my pan card.

PAN number for surrender - DG******5D

Since i have two pan card now i want to surrender one of my pan card whose pan number i have just entered above please kindly surrender my additional pan card as soon as possible.

Thank you.

Yours faithfully,

Signature:

Full Name :

My Address: XYZ Address.

Mobile No: 99999999999

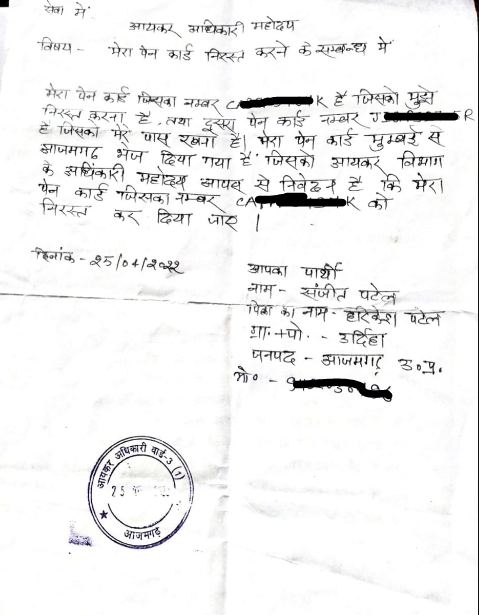

Example For Surrender Letter.

Hope you will write your own PAN card surrender letter. You must have learned something after reading the letter given above.

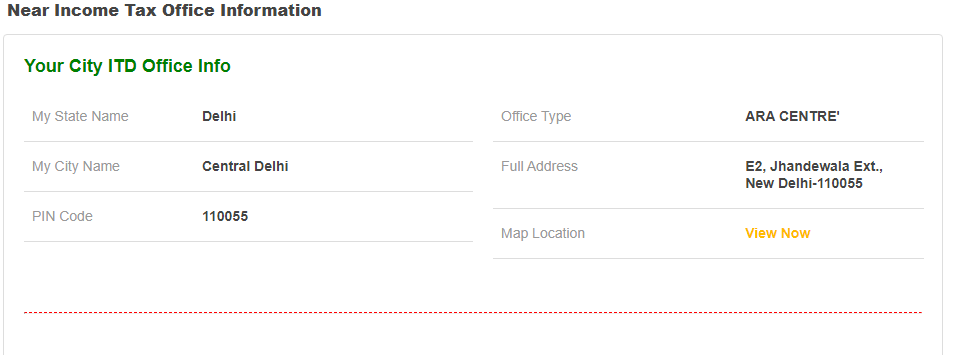

How to Check My City Income Tax Office Address

Why is the Assessing Officer (AO) Address needed, when we want to surrender or delink a PAN card, then we need the Assessing Officer (AO) Income Tax Office Address, this address is different for every person. It happens, because this office is one in every district in India, the districts which are small, which do not have this office, their area work is given to the neighboring district, how do you address the income tax office of your district can see online today we are going to learn.

To see the address of any Income Tax Office, you have to go to the section of Income Tax Office Address My Area.

https://aocodefind.go24.info/my-local-income-tax-office/

Then select your state, after that the list of all the districts in that state will come, then select the name of your district and click on the Go Now button.

Then you will get to see the address of the Income Tax Office in front of you, here you will also be given a link to the state, city, pin code, address location, Google measurement, as well as the office type.

So in this way you can also see the address of your city/district income tax office online.

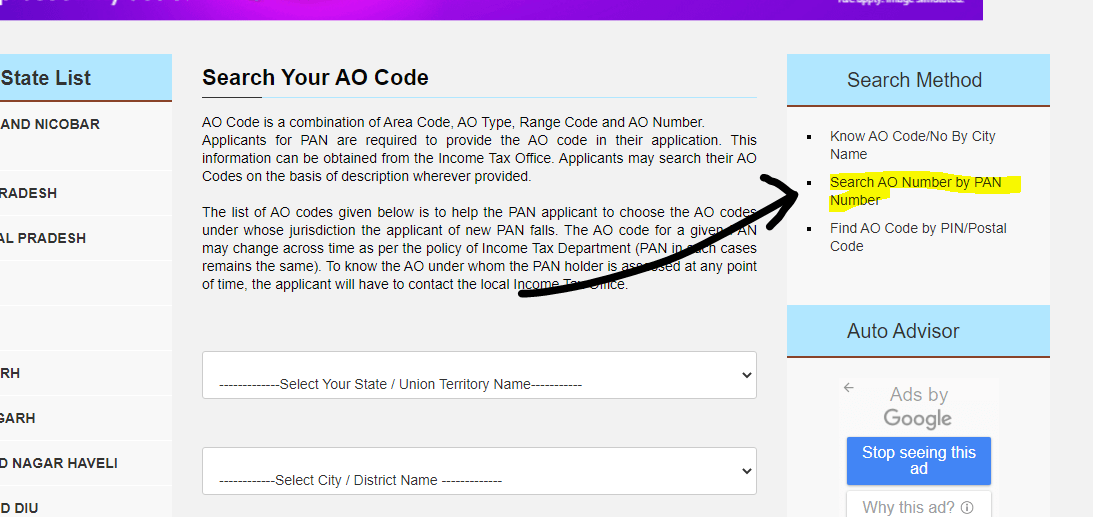

AO Income Tax Office Address Search Using PAN Number

We need to know the address of the Income Tax Office from the PAN card number, because we do not know which city’s Ao Code was entered while making our PAN card, because our PAN card is surrendered or delinked from the same place. And it will not happen from anywhere, if you go to the Income Tax Office of your district, to surrender the PAN card, then it is first checked at which AO Office this PAN card is issued, if your PAN card is from the same office. If it is done at the address then your PAN will be surrendered, but if the AO code of any other city was used while making your PAN card, then you will have to surrender the PAN card by going to the same Ao Office or from there PAN card to the income of your district. You will have to transfer it to the tax office, then your surrender letter will be accepted to surrender your PAN card.

To check the details of the AO Office of that place from the PAN card number, you have to follow the steps given below.

You have to open this link https://aocodefind.go24.info/ to check AO Office Details by PAN Card Number

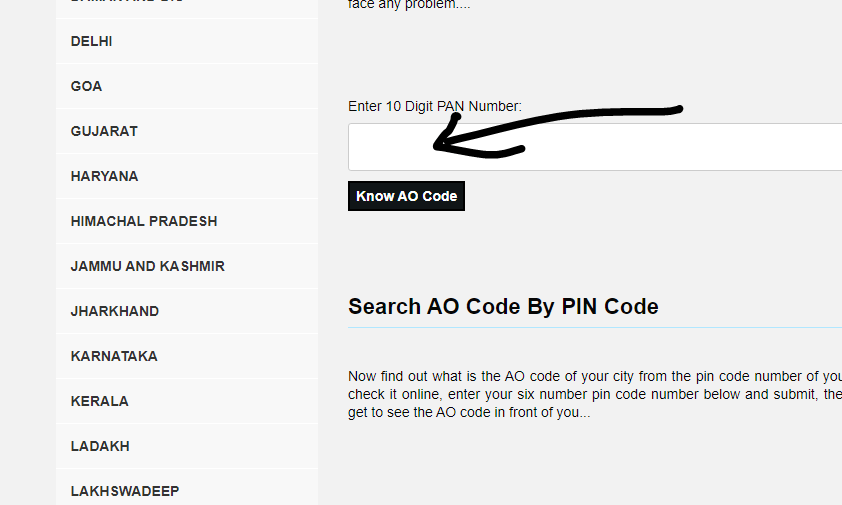

Then the AO Codefind website opens in front of you, now you have to click on the option “Search AO Number by PAN Number” in the right side.

Then you get the option to search AO Code from PAN number, now you have to enter your PAN number, and as soon as you click outside, the page will start loading and the result will come in front of you.

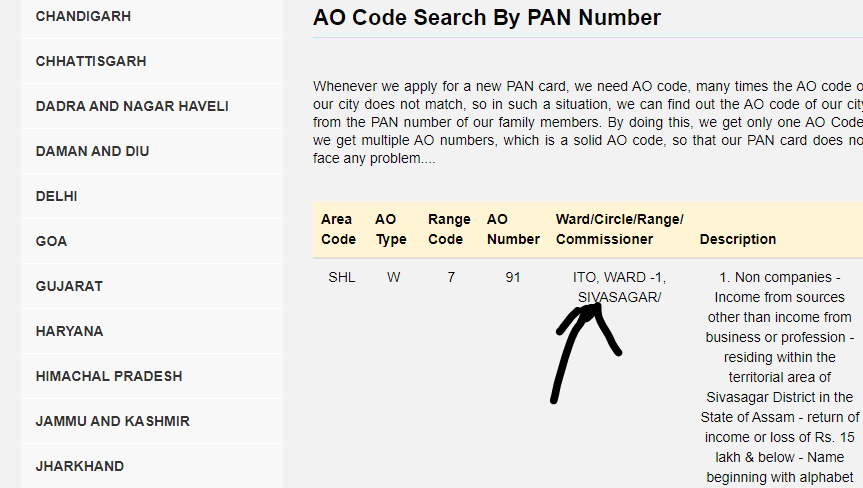

Then you get to see the details like Area Code, AO Type, Range Code, AO Number Ward/Circle/Range/Commissioner, Description etc., here you get to see the name of the city from which the city is made and which Ao The code was given while making the PAN card, that is also visible.

If you do not get to see the name of the city, then copy the AO code and search it in Google, then you will get to see the name of the city on the coffee, in this way you can find the address of the income tax office of any district. Also, I have told you how to write a letter, I have also given you a sample, hope that you have got to learn something new after reading the article.